08

Aug 2025

- BY Kevin Barry BSc(Hons) MRICS

- POSTED IN Latest News

- WITH 0 COMMENTS

- PERMALINK

- STANDARD POST TYPE

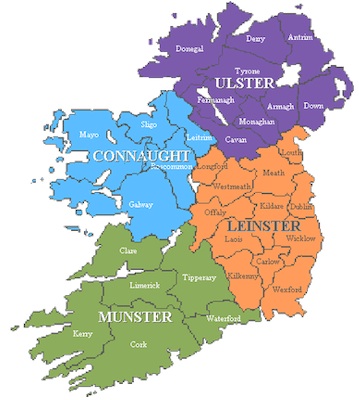

Summary of Construction Output (Year-to-Date 2025, £ Millions) Ireland (Republic of Ireland)

- Year-to-Date Construction Output: In 2024, Ireland’s construction output was valued at approximately €46 billion (£39.3 billion, using an approximate exchange rate of €1 = £0.854). For 2025, GlobalData forecasts a 3.3% growth in real terms, suggesting a total output of roughly £40.6 billion for the year, with year-to-date (January–August) estimates likely around £27–30 billion, assuming steady monthly distribution.

- Key Drivers: Growth is fueled by public and private investments in transport, electricity, and residential sectors. Notable 2025 investments include €713 million (£609 million) for regional roads and €436 million (£372 million) for 1,300 social homes by 2027. Residential construction remains strong, with loan approvals for 13,186 new homes in 2024 signaling continued momentum.

Northern Ireland

- Year-to-Date Construction Output: Q1 2025 project starts were reported at £814 million, an 87% increase over the previous three months and the prior year. Extrapolating from Q4 2024 data (where output reached a 15-year high with a 12.3% annual increase), year-to-date output for 2025 (January–August) could be estimated at approximately £2.5–3 billion, assuming sustained growth.

- Key Drivers: Housing output grew by 5.5% in Q4 2024, with repair and maintenance and infrastructure also contributing to earlier 2023 growth (17% and 9.3% year-on-year, respectively). However, Q4 2024 saw declines in infrastructure (-4.7%) and other work (-1.4%).

Comparison

- Scale: Ireland’s construction output is significantly larger, with an estimated year-to-date value of £27–30 billion compared to Northern Ireland’s £2.5–3 billion. This reflects Ireland’s larger economy and population, with construction output per capita historically higher (e.g., €7,600 in 2005 vs. lower figures for Northern Ireland).

- Growth Trends: Ireland projects steady growth (3.3% in 2025), driven by targeted investments. Northern Ireland shows volatile but strong growth in project starts (87% in Q1 2025), though quarterly fluctuations (e.g., Q4 2024 declines) suggest less stability.

- Sectors: Both regions emphasize residential construction, but Ireland’s scale is larger (e.g., 13,186 homes funded in 2024 vs. Northern Ireland’s smaller housing output). Northern Ireland’s infrastructure and repair sectors have shown recent strength but face public sector slowdowns due to political stalemate.

Notes

- Estimates are based on partial 2025 data and historical trends, as precise year-to-date figures for both regions are not explicitly reported. Exchange rate fluctuations (e.g., €1 ≈ £0.854) may affect comparisons.

- For more precise data, further details from the Central Statistics Office (Ireland) or Northern Ireland Statistics and Research Agency (NISRA) would be needed, as current sources lack granular 2025 breakdowns.