- BY Kevin Barry BSc(Hons) MRICS

- POSTED IN Latest News

- WITH 0 COMMENTS

- PERMALINK

- STANDARD POST TYPE

Construction Sector Health: Northern Ireland vs. Republic of Ireland (Oct 2025)

| Metric | Northern Ireland | Republic of Ireland |

|---|---|---|

| Activity (PMI, Sep 2025) | 45.2 (↓ 5% YoY) | 43.7 (↓ 2.2 pts MoM, 3-yr low) |

| Project Starts (Q3 2025) | £422m (↓ 51% YoY) | 1,653 homes (↑ 43% MoM) |

| Key Projects | Strabane Water, Belfast Greenway | MetroLink (€12.6B), Kilshane Energy (€250M) |

| Output Growth (2025 Forecast) | 3–5% (CIS/AECOM) ↑ | 6.6% (€11.83B, ResearchAndMarkets) ↑ |

| Labour Shortages | Moderate (trades, engineers) | Severe (Dublin, Cork, Kildare; 40–50k needed) ↑ |

| Challenges | Energy strategy delays, non-residential dip ↓ | Housing delays, 10% wage inflation ↓ |

| Strengths | Health/education pipelines ↑ | Residential surge, infrastructure investment ↑ |

Summary: ROI’s sector is larger and growing faster (↑) but faces severe labour shortages and rising costs (↓). NI maintains steady public project pipelines (↑) but struggles with scale and a sharp activity drop (↓). Both regions saw September slowdowns (↓).

Overall Ranking: The Republic of Ireland is generally faring better than Northern Ireland. Despite more severe labour shortages and cost pressures, ROI benefits from stronger project starts (↑ 43% MoM), a higher forecasted growth rate (6.6% vs. 3–5%), and larger-scale projects like MetroLink. NI’s sharper decline in starts (↓ 51% YoY) and smaller market size indicate a less robust recovery, though its stable public pipelines provide some resilience.

Key Construction News in Northern Ireland (October 17-23, 2025)

Key Construction News in Northern Ireland (October 17-23, 2025)

This week’s headlines highlight ongoing infrastructure upgrades, project starts, and sector challenges, with a focus on water, energy, and urban development. Northern Ireland’s construction output continues to show resilience, though recent data points to some quarterly declines amid broader recovery trends. Below is a curated summary of the most relevant updates.Major Project Announcements and Starts

- Strabane Water Infrastructure Scheme (Phase 2): Northern Ireland Water has initiated Phase 2 of a major upgrade on the Culmore Trunk Sewer in Strabane, led by the Farrans Glanua joint venture. The £multi-million project aims to improve water supply reliability and reduce disruptions. Works began this week, with completion expected in early 2026. This follows Phase 1’s success in minimizing outages.

- West Belfast Greenway Construction: Infrastructure Minister Liz Kimmins announced the start of construction on the first section of the West Belfast Greenway on October 15 (with updates continuing this week). The £10m+ cycling and walking route will enhance urban connectivity, with full completion targeted for 2027.

- Culmore Trunk Sewer Relining (Next Phase): Contractor GRAHAM begins relining works on Strand Road, Derry/Londonderry, in November (planning finalized this week). The project addresses aging infrastructure to prevent sewage overflows, with traffic diversions in place for 3-4 weeks.

- Dungannon Wastewater Treatment Works Upgrade: Minister views progress on the £44m revamp of Dungannon WwTW, focusing on enhanced capacity and environmental compliance. The scheme, now 60% complete, is on track for 2026 handover.

Sector Performance and Reports

- September 2025 Construction Activity: Latest data from Construction News shows a sharp quarterly drop, with project starts at £422m (down 48% from the prior three months and 51% year-on-year). Main contract awards and planning approvals also declined, signaling short-term caution in non-residential sectors. However, health and education pipelines remain robust, buoying optimism for Q4.

- Energy Strategy Delays: An Audit Office report highlights “considerable lagging” in Northern Ireland’s energy strategy implementation, including offshore wind and grid upgrades. Progress on key targets, like renewable integration, is behind schedule, potentially impacting £billions in future infrastructure investment.

- Belfast Office Fit-Out Completion: A £1.6m transformation of a global tech giant’s headquarters in Belfast was delivered on time and budget by local firm McLaughlin & Harvey. The project features sustainable elements like energy-efficient HVAC, underscoring NI’s growing role in tech-driven construction.

Emerging Whispers and Broader TrendsSocial media and industry chatter this week point to cautious optimism amid economic headwinds:

- Interconnector Buzz: Renewed discussions around a proposed 142km electricity cable linking Hunterston (Scotland) to Kilroot power station in NI, valued at £700m+. Feasibility studies are advancing, with whispers of EU funding ties post-Brexit; locals near Hunterston report early site surveys.

- Housing Pipeline Pressures: Unofficial murmurs on X suggest bottlenecks in social housing approvals, with one north Belfast scheme (424 units, £191m) sparking local opposition over “upmarket” siting—yet it’s proceeding despite protests. Broader forecasts predict a 46% residential starts surge in 2026, but water infrastructure lags could delay this.

- Renewables Momentum: Action Renewables’ pink-lit building in Belfast for Breast Cancer Awareness ties into whispers of green construction incentives, with firms like GRAHAM eyeing more cross-border energy projects (e.g., Liverpool docks extension).

| Category | Key Metric (Sep/Oct 2025) | Change vs. Prior Year |

|---|---|---|

| Project Starts | £422m | -51% |

| Main Contract Awards | £ undisclosed (decline noted) | – (down) |

| Planning Approvals | Varied (poor performance) | – (down) |

| Output Volume (Q2 2025 baseline) | +7.3% YoY | Positive trend, but Q3 dip expected |

Latest Construction News in the Republic of Ireland (October 17-23, 2025)

This week’s updates reflect a mixed picture for Ireland’s construction sector: while housing and infrastructure projects advance amid government support, activity levels dipped sharply in September, with the AIB Construction PMI hitting a near three-year low. Overall forecasts remain positive, projecting 6.6% growth to €11.83 billion in 2025, driven by housing and renewables. Below is a summary of key developments, focusing on the Republic.Major Project Announcements and Starts

- Dublin MetroLink Rail Approval: The Irish government granted a Railway Order on October 2 for the €12.6 billion (approx. $13.5 billion) MetroLink project, Ireland’s largest transport investment. This 18.8km automated line from Swords to St. Stephen’s Green, with an airport link, will handle up to 30 trains per hour. Procurement starts in 2026, with construction to follow, potentially reshaping Dublin’s connectivity.

- Kilshane Energy Power Plant: Construction on the €250 million, 293MW gas-fired plant in north Dublin is set to begin in Q1 2026. Led by Kilshane Energy, it will power up to 300,000 homes, bolstering energy security. Consultants CWPA highlighted its role in Ireland’s energy transition.

- Cleeves Riverside Quarter in Limerick: Developer Limerick Twenty Thirty unveiled final plans for this €400 million regeneration project, including housing, commercial space, and public amenities along the Shannon. Planning application to be lodged soon, marking the largest in their portfolio.

- Galway Housing Development: An Bord Pleanála approved 219 cost-rental and social homes on Dyke Road, a joint LDA-Galway City Council scheme. Construction could start soon, addressing local housing needs.

- Baile Chláir Shared Equity Scheme: Groundbreaking on a €23.6 million, 88-home development in Claregalway, including a crèche and playground. Galway County Council’s first council-led shared equity project, due by September 2026.

- Maigh Cuilinn Community Centre: Work began on the €9.3 million facility in Moycullen, Galway, providing multi-purpose spaces for the community. Expected completion in 2027.

- Kildare Biomethane Plant: Planning advanced for a €50 million facility to produce renewable gas for thousands of homes, emphasizing green energy infrastructure.

Sector Performance and Reports

- September PMI Decline: Construction activity contracted at its fastest rate since late 2022, with the AIB PMI falling to 43.7 (from 45.9). Housing output dropped for the fifth month, and employment fell for the first time in seven months, amid rising costs and softer demand.

- Housing Commencements Surge: Despite the PMI dip, new home starts jumped 43% in September to 1,653 units, per the Department of Housing—above the national average in areas like Cork.

- CIF Safety Campaign Launch: The Construction Industry Federation kicked off its 2025 “Back to Basics” campaign (October 13-24), urging firms to reinforce core safety practices. It includes site audits and training, following 70 height-related fatalities in the sector over the past decade.

- Budget 2025 Housing Measures: Property Industry Ireland noted mixed impacts from new incentives, boosting supply but challenged by planning delays. CIF forecasts sustained growth in residential and non-residential pipelines.

Emerging Whispers and Broader TrendsIndustry chatter on X and forums highlights skills shortages and sustainability pushes:

- Apprenticeship Pay Push: Midlands MEP Maria Walsh called for better wages in construction apprenticeships to attract talent, amid recruitment drives in engineering, IT, and building sectors.

- MMC and Digital Adoption: Discussions at the CIF Digital Construction Summit emphasized GS1 standards for traceability and AI roadmaps for efficiency. Whispers suggest MMC could break the “boom-bust” cycle, with events like the MMC Ireland Conference in November drawing interest.

- Renewables and Decarbonization: Buzz around incentives for green materials and carbon calculators, with firms like Sensori advancing data center sustainability. Apartment builds in private rentals reportedly stalled, shifting focus to social housing.

- Cork Retail Revival: Planning lodged to repurpose the former Roches Stores site with Elverys and new tenants, potentially trading by Christmas 2025—seen as a docklands catalyst.

| Category | Key Metric (Sep 2025) | Change vs. Prior Month |

|---|---|---|

| Total Activity (PMI) | 43.7 | -2.2 pts (contraction) |

| Housing Output | Declining (5th month) | – (down) |

| New Home Starts | 1,653 units | +43% |

| Employment | Fell (1st in 7 months) | – (down) |

| Projected Market Size (2025) | €11.83B | +6.6% YoY |

Hottest Counties in Ireland for Labour Shortages in Construction (as of October 2025)

Ireland’s construction sector is grappling with a nationwide labour crisis, exacerbated by ambitious housing targets (e.g., 50,500 homes annually under Housing for All) and infrastructure demands. Recent reports, including the government’s 2024 skills analysis and the Construction Industry Federation’s (CIF) Q3 2025 outlook, estimate a need for 40,000–50,000 additional skilled workers by 2027, with shortages in trades like carpentry, electrical work, plumbing, and project management. Wage inflation hit 10% in Q2 2025 due to competition for talent, per the Central Statistics Office.While data is not always broken down granularly by county, shortages are most acute where construction activity is booming—driven by population growth, urban development, and major projects like MetroLink in Dublin or data centres in the midwest. “Hottest” counties are those with the highest reported recruitment challenges, vacancy rates (e.g., via SOLAS apprenticeships and employment permits), and project delays linked to labour gaps. Based on 2025 analyses from CIF, ManpowerGroup Ireland, and regional economic bulletins:Top 5 Counties with Acute Shortages

- Dublin (Highest overall): Epicentre of the crisis, with 45% of national construction output but only 30% of the workforce. The AIB Construction PMI for September 2025 flagged Dublin’s housing starts (up 43% YoY) outpacing labour supply, leading to 15–20% project delays. Shortages hit hardest in skilled trades; over 60% of firms report issues hiring electricians and QS professionals.

- Cork (Rapid urban expansion): Second-busiest for residential and commercial builds, with new home commencements 50% above national averages. BPFI’s 2025 SME survey noted 65% of Cork contractors struggling with machine operators and labourers, tied to docklands regeneration and pharma expansions. Vacancy rates for apprenticeships are 25% higher than in 2024.

- Kildare (Infrastructure boom): Proximity to Dublin amplifies demand for transport/housing links (e.g., Naas upgrades). Government reports highlight shortages in steel erectors and roofers, with 55% of local firms citing labour as the top barrier to scaling retrofitting under the Climate Action Plan. Employment permits issued here rose 40% in H1 2025.

- Meath (Commuter belt pressure): Satellite to Dublin, facing acute gaps in general operatives (40%+ firms affected). Linked to M3 motorway extensions and 10,000+ planned units; CIF data shows Meath’s productivity down 8% due to unfilled roles, with calls for more cross-border workers from NI.

- Galway (Western growth hub): Emerging hotspot for renewables and housing (e.g., Baile Chláir scheme). Shortages in insulation specialists and plumbers are stalling 20% of projects, per IGBC’s 2025 skills audit. Regional vacancy rates are 30% for mid-level trades, driven by Atlantic Economic Corridor investments.

Broader Insights and Trends

- National Context: 83% of employers face recruitment hurdles (ManpowerGroup 2025 Survey), with SMEs hit hardest (80% of sector employment). Immigration via work permits (1,500+ issued Q1–Q3 2025) helps but falls short; experts advocate for priority visas and apprenticeship boosts (SOLAS targets 5,000 new starts in 2026).

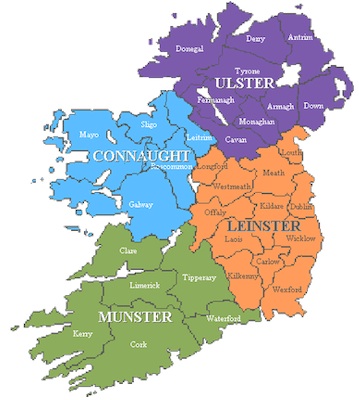

- Regional Variations: Leinster dominates due to 70% of activity, but Munster (Cork, Limerick) sees rising pressures from data centres. Connacht (Galway) and Ulster (border counties) lag slightly but are catching up with green energy projects.

- Mitigation Efforts: CIF’s “Back to Basics” campaign and EU-funded upskilling (€114m via RRP) aim to reskill 164,000 workers by 2030. Modern methods like MMC could cut labour needs by 20%, per IFAC.

| County | Key Shortage Trades | Est. Vacancy Rate (2025) | Main Driver |

|---|---|---|---|

| Dublin | Electricians, QS | 35–40% | Housing/Transport Boom |

| Cork | Machine Operators | 25–30% | Urban Regeneration |

| Kildare | Steel Erectors | 20–25% | Infrastructure Links |

| Meath | General Operatives | 20–25% | Commuter Housing |

| Galway | Plumbers, Insulators | 15–20% | Renewables Expansion |

Construction Sector Health: Northern Ireland vs. Republic of Ireland (Oct 2025)

| Metric | Northern Ireland | Republic of Ireland |

|---|---|---|

| Activity (PMI, Sep 2025) | 45.2 (↓ 5% YoY) | 43.7 (↓ 2.2 pts MoM, 3-yr low) |

| Project Starts (Q3 2025) | £422m (↓ 51% YoY) | 1,653 homes (↑ 43% MoM) |

| Key Projects | Strabane Water, Belfast Greenway | MetroLink (€12.6B), Kilshane Energy (€250M) |

| Output Growth (2025 Forecast) | 3–5% (CIS/AECOM) ↑ | 6.6% (€11.83B, ResearchAndMarkets) ↑ |

| Labour Shortages | Moderate (trades, engineers) | Severe (Dublin, Cork, Kildare; 40–50k needed) ↑ |

| Challenges | Energy strategy delays, non-residential dip ↓ | Housing delays, 10% wage inflation ↓ |

| Strengths | Health/education pipelines ↑ | Residential surge, infrastructure investment ↑ |

Summary: ROI’s sector is larger and growing faster (↑) but faces severe labour shortages and rising costs (↓). NI maintains steady public project pipelines (↑) but struggles with scale and a sharp activity drop (↓).

Both regions saw September slowdowns (↓).Overall Ranking: The Republic of Ireland is generally faring better than Northern Ireland. Despite more severe labour shortages and cost pressures, ROI benefits from stronger project starts (↑ 43% MoM), a higher forecasted growth rate (6.6% vs. 3–5%), and larger-scale projects like MetroLink.

NI’s sharper decline in starts (↓ 51% YoY) and smaller market size indicate a less robust recovery, though its stable public pipelines provide some resilience.