- BY Kevin Barry BSc(Hons) MRICS

- POSTED IN Latest News

- WITH 0 COMMENTS

- PERMALINK

- STANDARD POST TYPE

Alert: Vacant Property Rates About to Skyrocket to 100% – NI Owners, Don’t Let This Drain Your Profits!

As a non-domestic property owner in Northern Ireland, the clock is ticking on your vacant units. Finance Minister John O’Dowd recently confirmed plans to phase out the 50% relief on rates for empty commercial properties, ramping up liability to 75% within the current Assembly mandate (by 2027) and eventually to a full 100%.

This policy, part of an ongoing strategic review of the rating system, aims to combat dereliction, revitalize town centers, and generate an extra £20 million for public services.

With the review underway since June 2025 and proposals expected for consultation this autumn, now’s the time to act before higher bills hit. In this updated guide, we’ll break down the changes and provide actionable steps to safeguard your portfolio.

Understanding the Changes

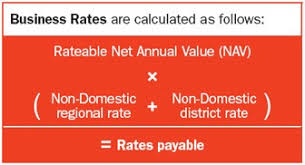

Vacant non-domestic properties currently enjoy a 50% rates relief, meaning owners pay half the standard bill. However, following a review initiated last year and advanced through 2025,

finance-ni.gov.uk this is set to change. The first hike to 75% could come soon, pending Executive approval, with full 100% liability phased in over several years to allow market adjustment.

irishnews.com Exemptions still apply for scenarios like listed buildings or short-term vacancies (under three months), but the core message is clear: holding empty properties will get costlier.

finance-ni.gov.uk This isn’t just policy talk—it’s a push for economic regeneration, but it could squeeze your finances if unprepared.

Action Plan: Steps to Take Right Now

Stay ahead with this refreshed strategy. Whether you own one shop or multiple units, prioritize based on your situation.

1. Assess Your Portfolio Immediately

- Why? Pinpoint vulnerable properties and forecast impacts early.

- What to do:

- Check your rates via Land & Property Services (LPS).

- Model costs: Use the official LPS rates calculator to simulate jumps from 50% to 75% (and 100%) based on your property’s rateable value.

- Timeline: Complete this week for clarity.

2. Prioritize Leasing or Renting Out Vacant Units

- Why? Occupancy eliminates vacant rates entirely, converting costs to income.

- What to do:

- Market proactively on sites like Rightmove Commercial or through local agents. Opt for flexible leases to appeal to SMEs.

- Incentives: Rent holidays or fit-outs could fill spaces faster, especially in high-vacancy areas.

- Collaborate: Engage councils or BIDs for support in promoting units.

- Timeline: Target tenants in 3-6 months to sidestep the 75% phase.

3. Explore Repurposing or Redevelopment

- Why? Adapting use might secure exemptions or boost value amid policy shifts.

- What to do:

- Consult planning: Reach out to your local council for rezoning options, like residential conversions.

- Funding: Investigate NI regeneration grants or Levelling Up schemes.

- Experts: Involve surveyors for viability assessments.

- Timeline: Initiate now—approvals take time.

4. Consider Selling or Asset Management Strategies

- Why? Unsustainable vacancies could force rushed decisions; act while market values hold.

- What to do:

- Valuate: Get professional appraisals.

- Sell smart: List via agents or auctions; bundle with occupied assets if possible.

- Taxes: Discuss CGT implications with advisors.

- Alternatives: Explore joint ventures or REITs.

- Timeline: List in 1-2 months if opting out.

5. Challenge Your Rates and Seek Reliefs

- Why? You may qualify for adjustments or ongoing reliefs during the transition.

- What to do:

- Appeal: Contest high rateable values with LPS—evidence wins cases.

- Exemptions: Verify eligibility for repairs or short vacancies.

- Advocate: Join bodies like Retail NI to influence the review. irishnews.com

- Timeline: Submit appeals promptly.

6. Budget and Financial Planning

- Why? Hikes could add significant annual costs.

- What to do:

- Scenario plan: Spreadsheet forecasts at 75% and 100%.

- Finance: Consider loans for bridges.

- Diversify: Shift to less-affected assets.

Final Thoughts: Seize the Opportunity Amid the Pressure

With the rating review in full swing and changes imminent, vacant properties are no longer a passive hold. This is your cue to innovate, lease, or divest—turning a potential hit into growth. Share your strategies below. For official updates, visit the Department of Finance rating policy page. Consult pros for tailored advice—your future savings start today!