- BY Kevin Barry BSc(Hons) MRICS

- POSTED IN Latest News

- WITH 0 COMMENTS

- PERMALINK

- STANDARD POST TYPE

Yes, there is a clear regional imbalance in job creation across Northern Ireland, with employment opportunities, productivity, and economic growth heavily concentrated in and around Belfast and eastern regions.

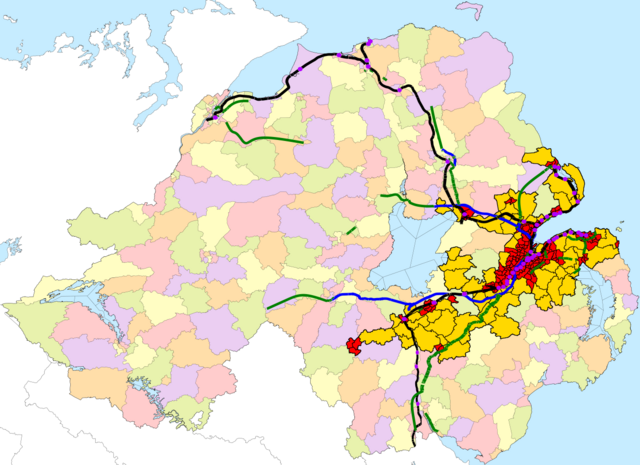

According to the 2021 census, just over 50% of Northern Ireland’s population lives in the highlighted red and yellow area in the map above. This area is concentrated around Belfast and nearby settlements (red), and features the greatest concentration of motorways, dual carriageways, railways and train stations (overlaid).

This is driven by factors such as skill concentrations, foreign direct investment (FDI), and sector strengths in professional services, ICT, and manufacturing in certain areas. Western regions tend to lag due to higher economic inactivity, lower productivity, and fewer high-quality job opportunities, though some sub-regions like Mid Ulster show strong performance.

Data is primarily available by Local Government Districts (LGDs) rather than historic counties, but I’ve mapped and approximated rankings for the six counties based on associated LGD performance using employment rates, growth trends, and productivity indicators from recent analyses (as of 2024-2025 data).Ranking of Counties by Job Creation Performance.

Rankings are based on a composite of resident employment rates (higher is better), employment growth (2001-2022), productivity (GVA per job filled), and FDI job concentration. Higher ranks indicate stronger job creation and lower imbalance relative to the NI average. Western counties generally rank lower, reflecting persistent disparities.

| Rank | County | Key Indicators and Notes |

|---|---|---|

| 1 | Antrim | High employment rates and growth in associated LGDs (e.g., Belfast at 178% NI GVA per capita average, Antrim & Newtownabbey, Mid & East Antrim, Lisburn & Castlereagh). Belfast dominates with 30% of NI jobs and 78% of FDI new jobs (2015-2022). Strong in ICT and professional services, but some sub-areas like Mid & East Antrim show declines due to manufacturing closures. |

| 2 | Armagh | Strong performance in Armagh City, Banbridge & Craigavon (ABC) LGD, with above-average employment growth driven by manufacturing and regional competitiveness. Mid Ulster (partial overlap) adds positive effects. GVA per job filled is mid-range but improving. |

| 3 | Down | Mixed but overall medium-high, with Newry, Mourne & Down showing above-average growth and export intensity. Ards & North Down lags (GVA per capita at 55% NI average), but Lisburn & Castlereagh and Belfast overlaps boost it. Strong in retail and construction in parts. Proposed bridge over Strangford Lough has been highlighted as a solution to such disparity. https://www.quintinqs.com/three-strand-approach-to-enhance-northern-irelands-connectivity/ |

| 4 | Tyrone | Variable performance; Mid Ulster excels (highest employment rate at 103% NI index, strong manufacturing), but Derry City & Strabane and Fermanagh & Omagh overlaps drag it down with lower growth and higher inactivity. Positive regional effects in SSA analysis. |

| 5 | Fermanagh | Below-average in Fermanagh & Omagh LGD, with concentration in low-growth sectors like agriculture and construction. GVA per job filled improving but still lags; negative industry mix effects in growth analysis. |

| 6 | Londonderry | Lowest overall, driven by Derry City & Strabane (lowest employment rate at ~91% NI index, highest inactivity at 132%) and Causeway Coast & Glens. Low GVA per job filled (87% NI average) and limited FDI (11% share). Some convergence in rates but persistent gaps. |

Infrastructure Limitations Highlighting Imbalances.

Infrastructure disparities exacerbate job creation imbalances, particularly limiting access to opportunities in western counties. Key limitations include:

- Transport Connectivity: Western counties (Londonderry, Tyrone, Fermanagh) have only 6% of NI’s rail network and 1% of motorways despite housing 27% of the population. Rail access is poor (e.g., only 25% of western towns over 10,000 people have rail stops vs. 88% in the east). The Belfast-Derry rail is underinvested, and roads like the A5 (western corridor) and A6 (to Derry) remain partially single-carriageway, delaying connectivity and economic development.

- Broadband and Digital: Rural western areas lag in full-fiber access (e.g., 10% of premises lack adequate speeds), constraining remote work and business growth, though initiatives like Project Stratum aim to address this.

- Energy and Utilities: Natural gas networks are urban-focused, leaving western rural areas reliant on costlier alternatives, hindering industrial job creation. Wastewater capacity issues in some areas limit new developments.

- Health and Education: Higher maintenance backlogs and surplus school places in rural west affect workforce skills and health outcomes, with 60% higher emergency admissions in deprived (often western) areas.

Overall, these factors contribute to a 10-15 percentage point gap in employment rates between top and bottom regions, with gaps narrowing slightly but imbalances persisting.

InvestNI hopes

The current Chief Executive Officer (CEO) of Invest Northern Ireland (Invest NI) is Kieran Donoghue, who was appointed in October 2023 and officially took up the role in early 2024, following an interim period led by Mel Chittock.

He previously worked at IDA Ireland, Ireland’s investment promotion agency.

His leadership is still relatively recent, and he has overseen significant organizational restructuring, including the April 2025 appointments of Anne Beggs as Chief Commercial Officer (effective May 2025) and Kathryn Hill as Chief Operating Officer.

These roles are part of a broader senior leadership overhaul to enhance commercial focus and operational efficiency.

Envisioned Changes Under Kieran Donoghue’s Leadership

Donoghue’s strategic vision emphasizes transforming Invest NI to position Northern Ireland (NI) for long-term economic success, aligning with the Economy Minister’s priorities: raising productivity, creating good jobs, achieving regional balance, and transitioning to net zero.

This is outlined in the agency’s 2024-2027 Business Strategy, which marks a “pivotal moment” for Invest NI and focuses on operational reforms in response to past criticisms.

Key envisioned changes include:

- Productivity and Innovation Boost: Investments in plant/equipment, automation, digitization, skills, and exports to drive higher-value economic activity. Initiatives include a £46 million Agri-Food Investment Initiative and a £20 million Energy Support Fund to aid the green economy transition. Emphasis on sectors like aerospace, defense, and advanced manufacturing, with events like the Farnborough Airshow used to showcase NI’s strengths.

- Regional Balance and Decentralization: A new Regional Property Programme and support for City and Growth Deal projects to promote growth outside Belfast, addressing historical east-west imbalances. This includes enhanced collaboration with local councils, universities, and stakeholders to tailor support to regional needs. Recent examples include investments in the north west, such as Seagate’s £115 million R&D project (creating 30+ jobs) and expansions by EY, FinTrU, Alchemy, AVEVA, and Napier AI in Derry/Londonderry.

- Operational and Digital Transformation: Restructuring Invest NI for better efficiency, including digitizing processes to reduce bureaucracy and make support more user-friendly. This builds on an Independent Review’s recommendations for profound internal changes. New funding rounds, like over £250 million in Access to Finance over 10 years for start-ups and SMEs, aim to support growth. A Sub-Regional Economic Plan was launched in October 2024 to boost performance across regions.

- Global Positioning and Collaboration: Leveraging NI’s resilience and innovation through international events (e.g., St Patrick’s Day in the US) and diaspora networks. Focus on navigating global challenges like de-globalization while capitalizing on opportunities in high-growth sectors. In 2024/25, Invest NI supported 236 investments in the north west alone, generating £165 million in total investment.

Donoghue’s initial impressions highlight NI’s entrepreneurial spirit and business resilience, drawn from engagements with local firms and stakeholders, but he stresses the need for urgent reforms to address volatility and build on strengths like aviation heritage.

Key Issues and Challenges

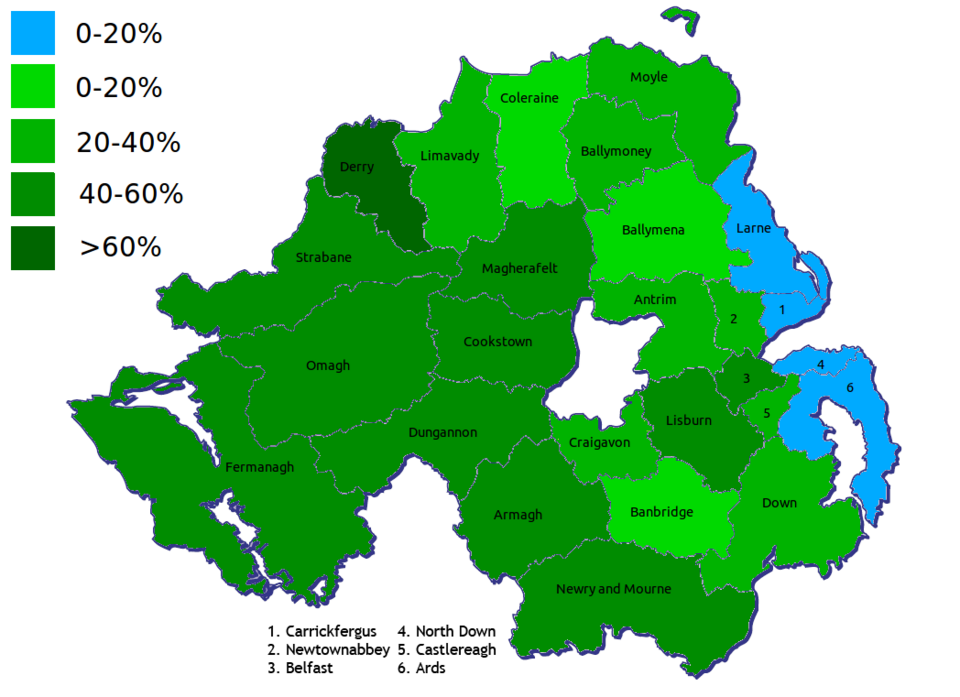

Invest NI has faced significant criticism, particularly around regional imbalances and operational shortcomings, which Donoghue’s changes aim to address. Above, shades of green show nationalist density. Major issues include:

- Regional Discrimination and Imbalance: Persistent allegations of favoritism toward Belfast and the east, with underinvestment in the north west (e.g., Derry/Londonderry). In June 2025, board member Kieran Kennedy resigned, citing “discrimination against the north west” after a decision to retain the regional office at Timber Quay without exploring alternatives. He expressed a loss of faith in leadership’s commitment to regional balance. Local politicians like Colum Eastwood and Sinead McLaughlin called it a “damning indictment,” noting failures to drive investment outside Belfast. A 2023 report highlighted Invest NI’s failure over years to create jobs, boost productivity, or invest beyond Belfast.

- Leadership, Operations, and Accountability: A 2023 Independent Review found urgent needs for improvements in leadership, operations, public accountability, and strategic delivery, with decision-making overly centralized in Belfast and a poor organizational culture. Challenges include Brexit impacts, political instability at Stormont, budget constraints, and inflationary pressures. Performance dipped during COVID-19, with reduced support reflecting broader economic declines.

- Budget and Resource Pressures: Severe budget strains, overspends, and constrained funding for NI, exacerbating delivery issues. The Department for the Economy has committed £5 million over three years to local partnerships in Derry and Strabane to address these gaps.

Invest NI defends its record by pointing to recent north west investments and strategy centering regional development, with board chair John Healy expressing disappointment in Kennedy’s resignation but affirming the leadership’s decisions.

Overall, while progress is underway, critics argue reforms have been slow, perpetuating imbalances.