- BY Kevin Barry BSc(Hons) MRICS

- POSTED IN Latest News

- WITH 0 COMMENTS

- PERMALINK

- STANDARD POST TYPE

NISRA has published figures on NI spending from 2015 to 2025.

Looking at the spending figures in the context of a potential united Ireland scenario, there would be several significant financial pressures and adjustments to consider:

Based on the comprehensive data from both documents, here’s an analysis of how Northern Ireland’s spending figures would compare with a united Ireland scenario and the pressures that would exist:

Current Spending Comparison (2024-25)

Northern Ireland per capita spending:

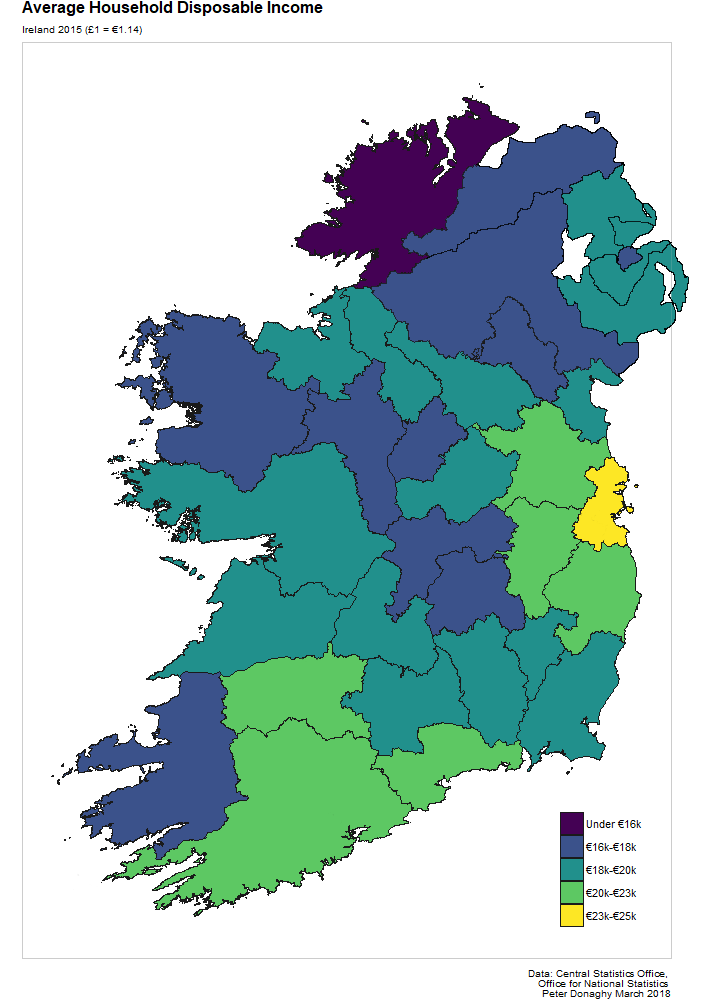

- Total: £16,600 per person (€19,400 approx)

- Public services (DEL): £9,600 per person

- Benefits/pensions (AME): £7,000 per person

Republic of Ireland per capita spending:

- Total: €23,200 per person (£19,900 approx)

- This breaks down into €114.4 billion total spending for 5.2 million people

Key Pressures in a United Ireland Scenario

1. Health System Integration Challenges

Current Systems:

- NI: NHS model – free at point of use, funded through taxation

- RoI: Mixed public/private with significant private charges

Major Pressure: In the Republic, “most GP surgeries are private businesses, and charges for a regular consultation cost between €45 and €65”, while NI has free GP care under NHS. Harmonizing these systems would be extremely costly.

2. Social Security System Harmonization

NI Current System:

- £13.4bn in benefits/pensions (2024-25)

- Full UK social security rates

RoI System: State pension of €277.30/week maximum (contributory) vs NI’s £203.85/week, but different qualification systems.

Pressure: Equalizing benefits upward would add billions to costs.

3. Funding Model Transformation

Current NI advantages that would be lost:

- £15.2bn resource spending represents about 25-27% premium over England

- Block Grant funding provides £732 million net of regional rates

RoI Revenue Model: €93.3 billion from taxation, with income tax (€35.2bn), corporation tax (€24.5bn), and VAT (€21.8bn) as main sources

4. Specific Service Harmonization Costs

Water Charges:

- NI has no domestic water charges

- RoI doesn’t have explicit water charges but introducing charges could raise £615 million based on roughly £800 per household

Education:

- Different systems (NI integrated vs RoI denominational)

- RoI spends €2.8bn on education vs NI’s £3.2bn but serves different population

5. Economic Integration Pressures

Corporation Tax:

- NI: 25% UK rate

- RoI: 12.5% rate generating €24.5 billion (26% of total tax revenue)

Integration would require: Harmonizing to the lower RoI rate, potentially reducing overall tax revenue initially.

6. Infrastructure Investment Needs

Current NI Infrastructure Spending: £932.7m (2025-26) RoI Infrastructure approach: More EU-integrated, different standards

Major Pressure: Upgrading NI infrastructure to EU standards while maintaining service levels.

Financial Arithmetic of Unity

Combined Population: ~7.1 million (5.2m RoI + 1.9m NI) Combined Current Spending: ~€130+ billion

Key Challenges:

- Immediate cost: Maintaining NI’s higher per-capita spending (£16,600 vs €14,500 RoI equivalent)

- Harmonization costs: Bringing both systems to highest common standard

- Revenue gap: Loss of UK subvention (£10bn+ annually) vs increased tax base

- Transition costs: Massive one-time systems integration costs

Conclusion

The spending data reveals that unification would face a “double squeeze”:

- Loss of the UK premium: NI currently receives 25-27% more funding per head than England

- Harmonization upward pressure: Tendency to harmonize benefits and services to the more generous level

The Republic would need to either:

- Dramatically increase taxation (potentially doubling current levels)

- Accept significant reduction in NI service levels

- Negotiate massive EU transition funding

- Implement major economic reforms to generate sufficient revenue

The scale of financial adjustment required would be unprecedented in European unification processes, making this one of the most complex fiscal integrations ever attempted. A reality check ?

Suggestions on the most prudent long term course of action shall follow !