- BY Kevin Barry BSc(Hons) MRICS

- POSTED IN Latest News

- WITH 0 COMMENTS

- PERMALINK

- STANDARD POST TYPE

Key Watchdogs Highlighting Cost Overruns in Irish Government Projects

The primary watchdog in Ireland for auditing public accounts and highlighting cost overruns is the Comptroller and Auditor General (C&AG), whose reports are often reviewed by the Oireachtas Public Accounts Committee (PAC). The Irish Fiscal Advisory Council (IFAC) also critiques broader fiscal spending overruns.

Based on available reports and analyses, below is a comprehensive list of major government projects and expenditures with documented cost overruns. This includes historical and recent examples from C&AG reports (e.g., 2023 accounts published in 2024) and related fiscal assessments.

Note that “all” overruns span decades, so this focuses on prominent cases; exhaustive historical audits would require accessing full archives.

Specific Project Overruns

| Project/Area | Original Estimate | Final/Current Estimate | Overrun Amount / Percentage | Details / Reasons | |

|---|---|---|---|---|---|

| National Children’s Hospital | €790 million (2015-2017 estimates) | €1.73 billion (2019 estimate, with additional costs for IT, accommodation, and inflation) | €940 million / 119% | Planning deficiencies (e.g., no cost-benefit analysis, underestimated risks), poor execution (coordination issues with guaranteed maximum price), and governance failures (project advanced without adequate oversight). Further escalations reported up to €1.443 billion in some accounts. | |

| National Broadband Plan | €500 million | €3 billion | €2.5 billion / 500% | Significant cost escalation due to scope changes and implementation challenges; no specific reasons detailed in summaries. | |

| Modular Homes for Ukrainian Refugees (Rapid Build Programme) | €200,000 per unit (€100 million for 500 units) | €442,000 per unit (€289.3 million total) | €242,000 per unit / 120% (plus €310,000 in storage costs) | Delays (17 months late), site issues, and lack of long-term planning; no credible future use determined. Example: Rathdowney units at €345,000 each vs. local average home price of €263,000. | |

| MetroLink (Dublin Rail Project) | Not specified (earlier metro-related projects: €225 million Exchequer funding written off) | €181 million spent to date (no construction started) | €225 million written off + ongoing costs | Huge delays in progression; funds from prior versions abandoned. Part of broader rail investments flagged for inefficiencies. | |

| National Train Control Centre | Not specified | Potential additional €40 million | €40 million | Delays and cost pressures in rail infrastructure; specific details limited in summaries. | |

| State Online/IT Projects (Various) | €350 million (approx., based on 20% under original) | €420 million | €70 million / 20% | Average 25% longer delivery time; issues with planning and execution across multiple digital initiatives. | |

| Motorway Programme (National Roads Network, 1999-2004) | €5.6 billion | €16 billion | €10.4 billion / ~186% | Half the roads delayed; systemic underestimation of costs and timelines. | |

| PPARS Payroll System (Health Sector) | €9 million | €220 million | €211 million / ~2,344% | Software outdated, only one-third of employees covered; poor project management. | |

| Luas Line 1 (Tram System) | Not specified | Not specified | 289% | First construction phase; systemic overruns in infrastructure. | |

| Dublin Port Tunnel | Not specified | Not specified | 160% | General infrastructure overruns; lessons not learned for future projects. | |

| Local Infrastructure Housing Activation Fund (LIHAF) | Planned for 20,000 homes (30 projects) | Revised to 16,000 homes (6 projects canceled, only 6,418 delivered by 2023) | Delays of 4-10 years; underdelivery of ~14,000 units | Most projects incomplete; planning delays and inefficiencies. |

Broader Fiscal and Spending Overruns (Non-Project Specific)These are highlighted by IFAC and C&AG for overall government budgeting, often due to poor planning:

- 2025 Gross Voted Spending: Planned €3 billion increase, but actual likely €7.6 billion (overrun of €4.6 billion).

- Current Spending (2025): Implied 1.4% growth, actual 6.1% by August (departments like Education, Children, Justice: 7.5% vs. 2.5% projected; Health: 5.8% vs. 4.1%).

- 2025 Total Expenditure: €108.7 billion ( €3.3 billion over Budget 2025); current spending ~€1 billion higher than Summer Economic Statement.

- Carbon Tax Receipts (2020-2023): €1.36 billion allocated, but only 61% verified as spent on environmental schemes (39% unverified, potential waste).

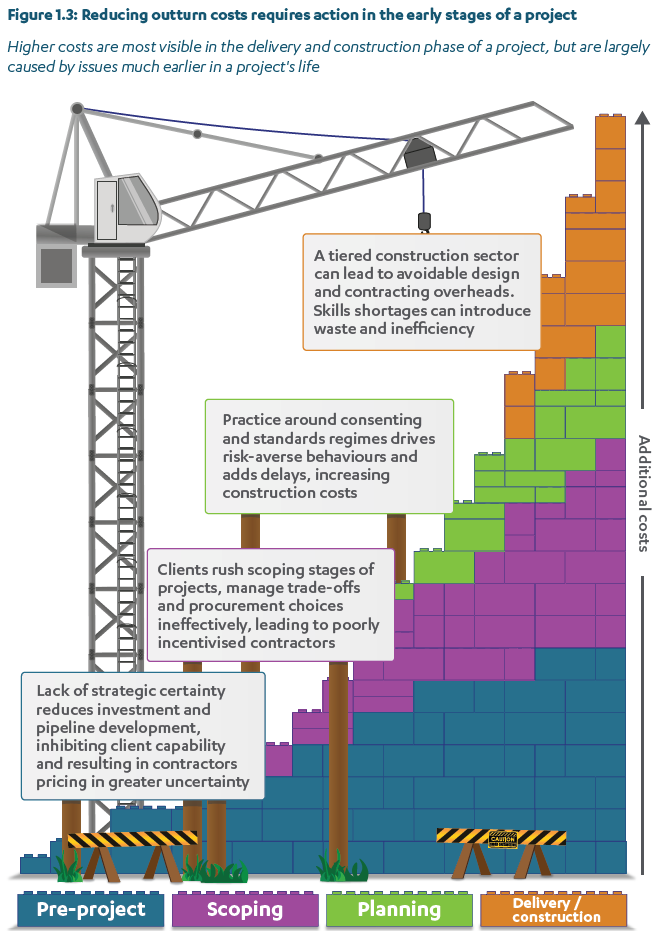

These overruns often stem from systemic issues like planning delays, risk underestimation, and lack of accountability, as noted in C&AG reports.

For the most recent full details, refer to the C&AG’s 2023 Accounts Report (published September 2024) or ongoing PAC examinations.