- BY Kevin Barry BSc(Hons) MRICS

- POSTED IN Latest News

- WITH 0 COMMENTS

- PERMALINK

- STANDARD POST TYPE

Demand Isn’t the Problem: Infrastructure Capacity Is Holding Northern Ireland Back

Executive Summary

Northern Ireland’s infrastructure challenge is not a lack of demand for housing, jobs, or investment. It is a lack of capacity in essential networks, particularly wastewater infrastructure and, increasingly, electricity.

Independent audit evidence shows that in many towns and cities, infrastructure systems are already operating at or beyond capacity, preventing development from proceeding regardless of planning approval or market demand. Historic underinvestment and short-term capital funding have eroded spare capacity faster than it can be restored. Industry, utilities, and auditors are aligned on the diagnosis: without sustained, multi-year investment to rebuild headroom in long-life assets, Northern Ireland will continue to constrain growth by default.

Northern Ireland’s Infrastructure Constraint Is Capacity, Not Demand

Northern Ireland does not lack demand for development. It lacks infrastructure headroom.

Across housing, economic development, and decarbonisation, demand is clear and sustained. What repeatedly prevents delivery is not ambition or consent, but the physical limits of core infrastructure networks—most critically wastewater, and increasingly electricity.

This is a structural issue, not a short-term disruption.

Where Infrastructure “Need” Sits in Practice

Responsibility for infrastructure policy and delivery rests primarily with the Department for Infrastructure (DfI) and associated statutory bodies. In practice, however, infrastructure “need” only becomes effective when it is translated into funded, multi-year capital programmes capable of restoring spare capacity in long-life assets.

Where that translation does not occur, demand accumulates against fixed limits.

Demand Is Real — but It Is Not the Binding Constraint

Demand pressures are well established and broadly uncontested:

- Ongoing housing need driven by demographics and household formation

- Economic and industrial development requiring serviced land

- Electrification and renewables, increasing electricity connection requests

None of these pressures are exceptional. The difficulty is that infrastructure capacity has not expanded in parallel, leaving networks unable to absorb growth.

Wastewater: The Hard Stop

Wastewater infrastructure is now the clearest constraint on development.

Independent audit evidence confirms that in around 100 areas across Northern Ireland, including roughly 25 main towns and cities, wastewater and sewerage systems cannot support additional development. In those locations, planning approvals are delayed, restricted, or refused due to capacity limits rather than policy preference.

Importantly, NI Water has stated that in some catchments developer-funded solutions are no longer capable of resolving the constraint. Once that point is reached, the issue becomes systemic rather than site-specific.

The consistent conclusion across audit and utility evidence is that historic underinvestment and stop-start capital funding have eroded spare capacity faster than it can be replaced.

Electricity: A Growing Capacity Risk

Electricity infrastructure constraints are increasingly visible, though expressed differently.

Rather than outright refusals, they manifest as:

- Longer grid connection queues

- Significant reinforcement requirements

- Uncertain costs and extended delivery programmes

The publication of formal network capacity mapping and recent policy interventions on grid connection charging reflect an accepted reality: demand for electricity connections is outpacing available local network capacity in many areas. Without anticipatory investment, electricity risks becoming a binding constraint similar to wastewater.

Delivery Capacity Still Matters

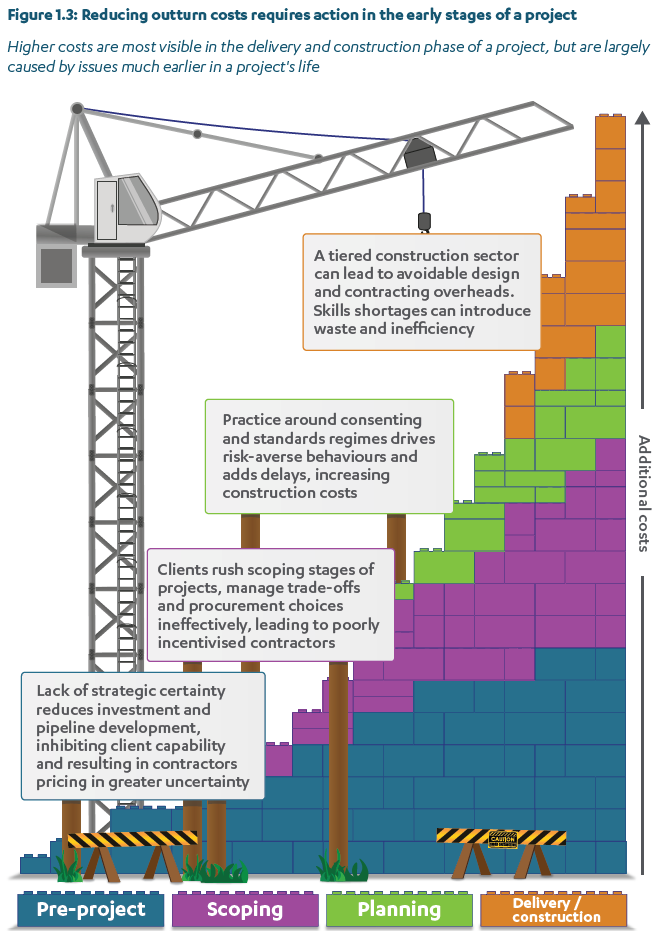

Even where funding and approvals align, infrastructure delivery is constrained by industry capacity.

Construction workforce forecasts show Northern Ireland requires in excess of 1,000 additional workers per year through the second half of the decade simply to meet expected demand. Infrastructure programmes cannot be accelerated without parallel investment in skills, labour, and specialist capacity.

Stop-start investment reduces productivity and increases cost and risk.

Industry View: Capacity, Not Consent

Recent public commentary from the Construction Employers Federation (CEF) reinforces this evidence base. Industry bodies are not arguing that demand is excessive, but that core infrastructure systems are already full, and that without stable, long-term funding mechanisms—potentially including dedicated revenue streams—Northern Ireland will continue to ration growth by default.

This position aligns closely with audit findings and statutory utility statements.

Conclusion: An Engineering Reality

Northern Ireland’s infrastructure challenge is often framed as a planning or political problem. The evidence points elsewhere.

It is fundamentally an engineering and asset-capacity issue, created by prolonged underinvestment in long-life systems and reinforced by short-term funding models. Until spare capacity is restored ahead of demand, housing delivery, economic development, and climate objectives will continue to collide with physical limits.

That conclusion is not ideological. It is supported by auditors, utilities, and industry alike.

Footnotes

- Northern Ireland Audit Office (NIAO) – Funding Water Infrastructure in Northern Ireland: identifies ~100 constrained areas (incl. ~25 towns/cities) where wastewater capacity prevents development.

- NI Water – published planning and capacity statements confirming locations where developer-funded solutions are no longer feasible.

- NIE Networks – Network Capacity Map and connection policy publications evidencing geographically constrained electricity capacity.

- Department for the Economy – grid connection charging policy decisions addressing reinforcement cost and queueing issues.

- CITB Northern Ireland – Construction Skills Network forecasts identifying the need for ~1,000+ additional workers per year through the late 2020s.

- Construction Employers Federation (CEF) – public statements and joint industry reports identifying wastewater capacity as a critical constraint on housing and economic growth.