- BY Kevin Barry BSc(Hons) MRICS

- POSTED IN Latest News

- WITH 0 COMMENTS

- PERMALINK

- STANDARD POST TYPE

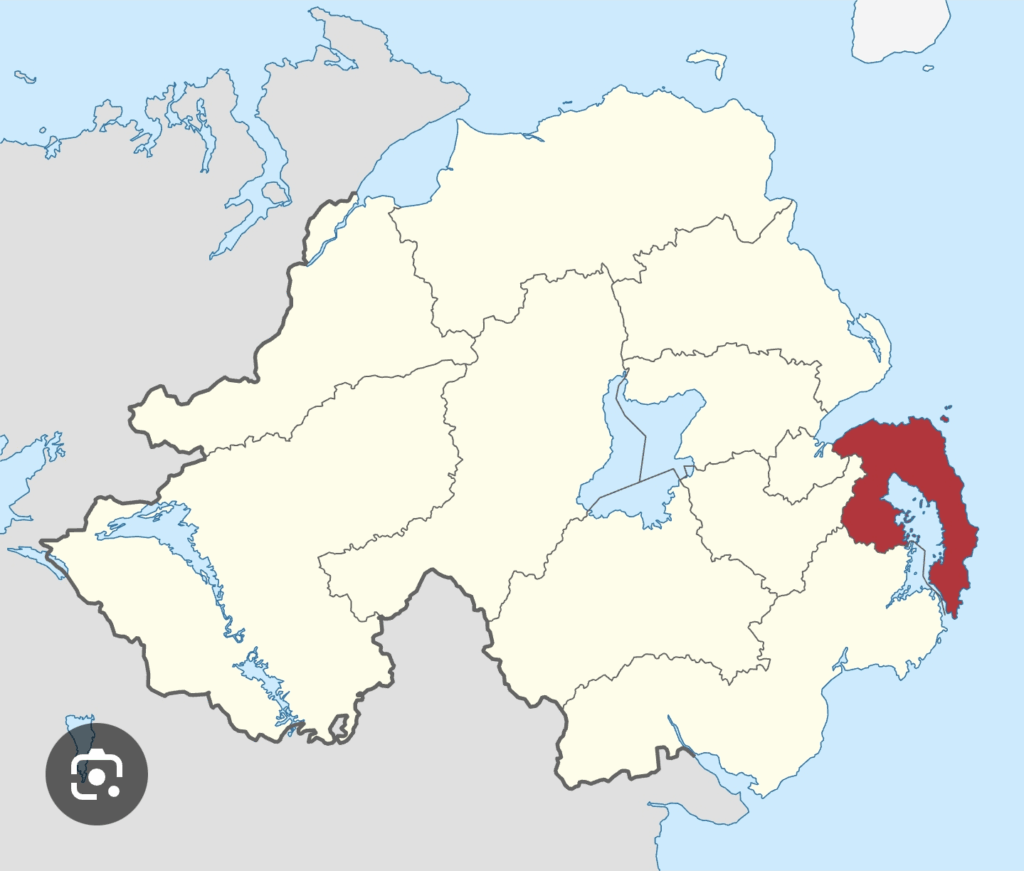

Ards Borough Council merged with North Down Borough Council on April 1, 2015, to form Ards and North Down Borough Council.

Introduction

Outsourcing leisure services, such as the management of sports centers, gyms, and recreational facilities, has been a common strategy for UK local councils aiming to address budgetary pressures and improve efficiency. This approach involves contracting private companies or trusts to operate these services, often with the goal of reducing public expenditure.

However, in light of ongoing expenditure issues like austerity-driven cuts, rising operational costs, and post-COVID financial strains, a critical assessment reveals a mixed picture. While outsourcing can offer short-term cost relief and access to specialized expertise, it frequently leads to hidden costs, reduced quality, and long-term financial burdens, prompting a trend toward insourcing.

Advantages of Outsourcing Leisure Services for Expenditure Management

Proponents of outsourcing argue that it can alleviate expenditure issues by leveraging private sector efficiencies and innovation. Private operators often bring investment in facilities without upfront public capital, potentially reducing maintenance and upgrade costs for cash-strapped councils. For instance, outsourcing can enable cost savings through economies of scale, competitive tendering, and performance-based contracts that incentivize revenue generation from user fees.

In some cases, this has allowed councils to focus core budgets on essential services while shifting operational risks to contractors. Additionally, trusts or non-profit models, like those used in leisure outsourcing, can benefit from tax advantages (e.g., VAT exemptions), lowering overall expenditure. Evidence from UK councils suggests that well-structured contracts can deliver initial savings, with private firms absorbing fluctuations in demand or costs, such as energy bills, which have surged post-2022.

Disadvantages and Expenditure Risks

Despite these potential benefits, outsourcing often exacerbates expenditure issues rather than resolving them. A key criticism is the erosion of promised savings due to contractor profit margins, management fees (typically 12-19%), and cost-plus pricing structures that diminish incentives for efficiency.

Research indicates that outsourced contracts can lead to inflexibility, with fixed payments ring-fencing budgets and limiting councils’ ability to reallocate funds during crises, effectively amplifying austerity impacts. Quality degradation is another concern, as private operators may cut corners to maximize profits, resulting in higher long-term repair costs or lost revenue from user dissatisfaction.

The COVID-19 pandemic highlighted these vulnerabilities, with many outsourced leisure providers requiring increased subsidies or emergency bailouts, leading to unplanned expenditures. Furthermore, contract failures or renegotiations often incur additional legal and transition costs, and staff transfers under TUPE regulations can introduce pension liabilities that inflate budgets. Surveys of UK councils show that insourcing, the reverse process, has yielded significant savings—up to £2 million annually in some cases—by eliminating these overheads and improving supply chain control.

Case Study: Ards and North Down Borough Council

Ards and North Down Borough Council provides a pertinent example of outsourcing’s financial implications amid expenditure challenges. The council operates a mixed model: facilities from the former North Down area are outsourced to Serco via the Northern Community Leisure Trust (NCLT), while others remain in-house. In recent financial years, the council has faced deficits, with leisure subsidies to NCLT/Serco escalating from £437,500 pre-COVID to £1,584,500 during the pandemic, contributing to overall budgetary strain.

The council’s 2023-2033 Leisure Strategy acknowledges the need for financial support and potential outsourcing consultations, but highlights risks like user consent requirements and dependency on external funding.

Recent debates, including a 2023 motion to delay outsourcing decisions for facilities in Ards, Comber, and Portaferry, reflect concerns over cost projections and quality. By 2025, proposals for further privatization have sparked public protests and union campaigns, citing fears of higher labour costs (potentially £20 million extra) and reduced service accessibility.

This mirrors broader UK trends, where councils like Halton have insourced leisure services to save £750,000 annually, suggesting outsourcing in Ards and North Down may not sustainably address deficits.

Conclusion

In critically assessing outsourcing leisure services amid expenditure issues, the evidence points to a cautionary tale: while it can provide initial fiscal relief and operational expertise, it often fails to deliver lasting savings and can compound financial pressures through fees, subsidies, and inflexibility. The shift toward insourcing in many UK councils underscores the value of direct control for cost efficiency and quality, particularly in an era of tight budgets and external shocks like inflation or pandemics.

For councils like Ards and North Down, facing persistent deficits, a hybrid or fully in-house model may offer a more sustainable path, provided robust planning mitigates transition costs. Ultimately, decisions should prioritize long-term value over short-term expediency, with thorough realistic and accurate financial modeling and stakeholder input.

Real, independently verified cost savings are required to balance books and a quandary for all NI councils.

Comparison across all 11 Councils

Overall Context on Northern Ireland Councils’ Financial Performance.

Northern Ireland’s 11 local councils operate under significant financial pressures, as highlighted in the latest available Local Government Auditor Report (published in 2024, covering the 2022-23 financial year). Across all councils, total income was approximately £1.03 billion, while expenditure reached £1.16 billion, resulting in a record sector-wide deficit of £128 million (11% shortfall). This gap was primarily driven by reduced central government funding and rising costs, raising concerns about long-term sustainability. Councils have relied on usable reserves (totaling £447 million, higher than pre-pandemic levels) to bridge deficits, but the auditor emphasized the need for robust reserve management plans. Borrowing has decreased to £437 million, reflecting lower capital spending amid economic uncertainty. All councils received unqualified audit opinions on their financial statements, but some faced qualified opinions on performance improvement or statutory reporting, and issues like high staff sickness absence (average 16.9 days per employee) and planning delays were noted.

Given the lack of publicly available individual council surplus/deficit figures for more recent years (2023-24 or 2024-25), a direct comparison of budget balances is challenging. However, councils balance their budgets through a combination of income sources, including district rates (local property taxes), which they set annually to cover projected shortfalls after accounting for other revenues and expenditures. The percentage increase in district rates serves as a useful proxy for assessing budget balancing: lower increases suggest better cost control, higher efficiency, or alternative income generation, while higher increases indicate greater pressure to raise revenue to avoid deficits or deplete reserves. Rate increases are influenced by factors like inflation, service demands, and legacy issues from local government reform.For this assessment, I rank the councils based on their domestic district rate % increase for the 2025-26 financial year (the most recent available, set in early 2025). Lower increases are ranked higher, indicating stronger performance in balancing budgets with minimal additional burden on households. Data is drawn from comprehensive reporting on rate settings.

Where relevant, I incorporate auditor concerns from the 2022-23 report for added context.

Ranking of Councils by Budget Balancing (Lowest to Highest Domestic Rate Increase for 2025-26)

| Rank | Council | Domestic Rate Increase (%) | Critical Assessment |

|---|---|---|---|

| 1 | Ards and North Down | 3.65% | Strong performance in minimizing rate hikes, suggesting effective cost management or revenue diversification. No major auditor concerns noted in 2022-23. Average household impact: +£1.75/month. |

| 2 | Causeway Coast and Glens | 3.65% | Tied for the lowest increase, indicating solid budget control despite economic pressures. Auditor noted high agency staff costs (29% of staff costs in 2022-23), which could pose future risks if not addressed. Average household impact: +£1.80/month. |

| 3 | Fermanagh and Omagh | 3.76% | Low increase reflects prudent financial planning. No specific auditor concerns; reserves and debt levels appear stable. Average household impact: +£1.50/month. |

| 4 | Armagh City, Banbridge and Craigavon | 3.91% | Relatively low hike, pointing to balanced budgeting. No major issues flagged by auditor. Average household impact: +£1.81/month. |

| 5 | Newry, Mourne and Down | 3.98% | Modest increase suggests good fiscal discipline. No significant auditor concerns. Average household impact: +£2.06/month. |

| 6 | Lisburn and Castlereagh | 3.99% | Low increase indicates efficient operations. No auditor concerns noted. Average household impact: +£1.64/month. |

| 7 | Mid and East Antrim | 3.99% | Tied with Lisburn; low hike is positive, but auditor raised serious issues in 2022-23 (four Priority 1 recommendations on financial controls, contract management, and governance), which could undermine long-term balancing if unresolved. Average household impact: +£3.92/month (higher due to baseline rates). |

| 8 | Antrim and Newtownabbey | 4.96% | Moderate increase, suggesting some pressure but overall control. No major auditor concerns. Average household impact: +£3.03/month. |

| 9 | Derry City and Strabane | 4.92% | Higher-than-average hike may reflect challenges in cost containment. Auditor issued a qualified opinion on statutory reporting duties in 2022-23 (late publication of improvement plans), potentially affecting transparency in budgeting. Average household impact: +£2.41/month. |

| 10 | Mid Ulster | 5.1% | Elevated increase indicates budget strains, possibly from rising expenditures. No specific auditor concerns, but sector-wide trends like sickness absence could amplify issues. Average household impact: +£1.96/month. |

| 11 | Belfast | 5.99% | Highest increase among councils, signaling significant balancing challenges for the largest council. Auditor qualified the 2022-23 opinion on performance improvement (unable to demonstrate improvement track record), which may contribute to ongoing fiscal pressures. Average household impact: +£2.76/month. |

Key Insights and Recommendations

- Top Performers (Ranks 1-5): These councils demonstrate stronger budget balancing by keeping rate increases below 4%, likely through efficiencies, reserve usage, or non-rate income. They appear more resilient to sector-wide deficits.

- Lower Performers (Ranks 9-11): Higher increases suggest greater reliance on ratepayers to close gaps, potentially due to higher expenditures or inefficiencies. Councils like Belfast and Mid and East Antrim face additional risks from auditor-flagged governance issues.

- Overall Critique: While all councils are balancing budgets in the short term (often via reserves), the persistent sector deficit and falling income highlight systemic vulnerabilities. The auditor recommends increasing fee-based income and better managing absences/planning to improve sustainability.

- Future assessments would benefit from more granular per-council deficit data, which is not currently centralized beyond aggregate reports. If trends continue, some councils may need to cut services or further tap reserves, risking depletion.